CÔNG TY CỔ PHẦN ĐẦU TƯ NAM LONG (HOSE: NLG)

Số 6 Nguyễn Khắc Viện, P. Tân Phú, Quận 7, TP.HCM

Điện thoại: (84.28) 54 16 17 18

Fax: (84.28) 54 17 18 19

31/07/2023

Nam Long Group (HOSE: NLG) has taken steps to achieve positive results amidst the unprecedented challenges faced by the real estate market. One of these steps is to break down delivery orders or speed up the delivery process.

Expedite delivery contributing to 15% increase in profit within the first 6 months

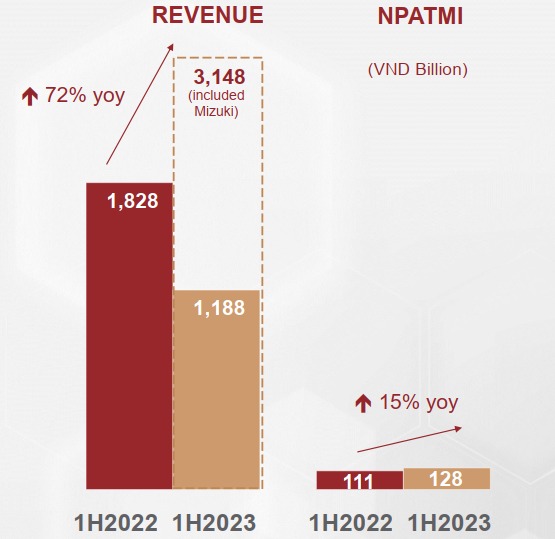

As a result, in Q2/2023, NLG achieved a net revenue of over VND 953 billion, with a gross profit margin of nearly 59%, a significant improvement compared to the same period last year at 45%. Therefore, NLG reported a pre-tax profit of nearly VND 320 billion, a 32% increase compared to the same period. Net profit reached nearly VND 121 billion, a 10% increase.

In the first six months of 2023, NLG achieved a net profit of nearly VND 128 billion, a 15% increase compared to the first half of 2022.

Tran Xuan Ngoc, the CEO of NLG, recently shared that the company's first-half results were a testament to their great effort. The profits for this period came mainly from the group's core business activities, including sales and construction efforts to deliver products to customers.

Despite a slow sales situation in Q1, NLG saw improvement in Q2 and focused on pushing construction to deliver houses. Surprisingly, despite having to pay an additional 45% to receive delivery, NLG's customers received their products on time or even ahead of schedule. This positive sign indicates that Nam Long's customers are genuine homebuyers, not speculators.

The Mizuki project and the Waterpoint project were the main contributors to the first-half results, generating revenues of VND 1,960 billion and VND 931 billion, respectively.

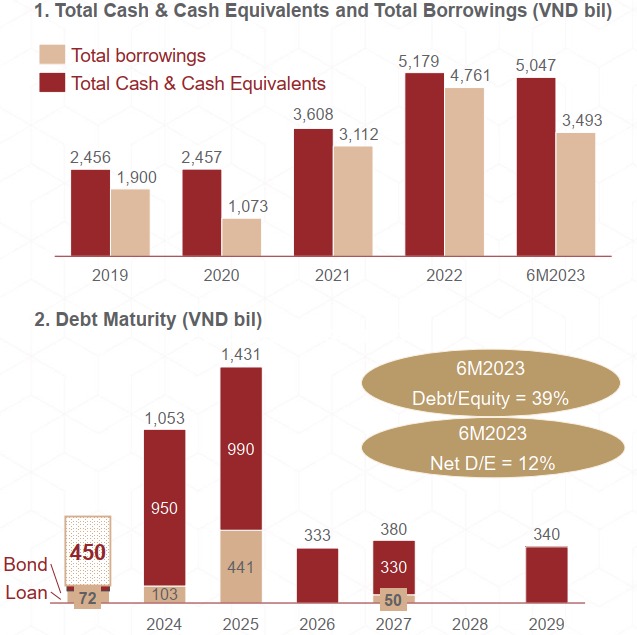

NLG has maintained a healthy financial structure, with a total outstanding loan of VND 5,047 billion and a cash balance of VND 3,493 billion as of the end of June. The company fully and timely paid a VND 450 billion bond in June 2023 and only has a remaining loan balance of VND 72 billion due from now until the end of 2023.

NLG's long-term debt structure consists of 40% fixed interest rates and 60% floating interest rates. Despite the sudden increase in market interest rates over the past two years, NLG's average interest rate remains stable, according to CEO Tran Xuan Ngoc.

Break down orders, revenue soaked to VND 867 billion

In terms of sales, Nam Long faced a sluggish real estate market in Q1 2023 like other companies in the industry.

Sales activities improved in April, with Q2 sales revenue reaching over VND 600 billion. This brought the total sales for the first six months to VND 867 billion, with sales at the Southgate project reaching VND 197 billion, Akari project reaching VND 378 billion, and Mizuki Park project reaching VND 292 billion.

Besides receiving support from general policies such as the tendency of decreasing interest rates, to achieve these results, Nam Long implemented a new policy of breaking down sales baskets to check the market's absorption level.

This policy has yielded positive results, and Nam Long has developed suitable business policies with an overall strategic approach to ensure sales for the last six months of the year, according to CEO Tran Xuan Ngoc.

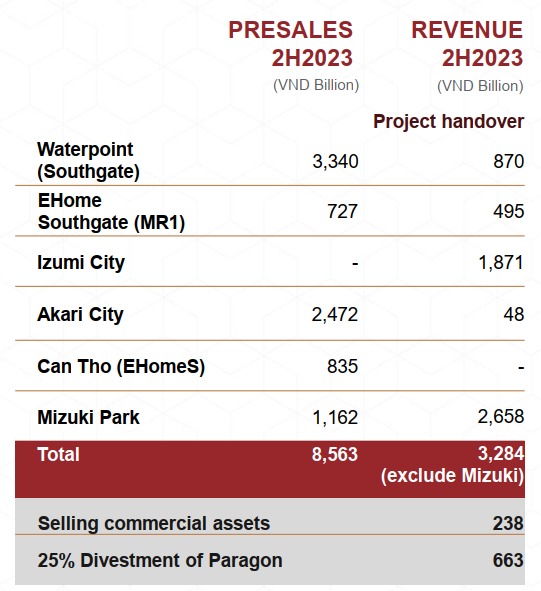

Mr. Ngoc also revealed that the company's revenue and profits in H2 2023 will come from selling some commercial real estate and the remaining 25% of Paragon (earning 663 billion VND).

Source: Vietstock

16/01/2024

The lively look of Mizuki Park Township