CÔNG TY CỔ PHẦN ĐẦU TƯ NAM LONG (HOSE: NLG)

Số 6 Nguyễn Khắc Viện, P. Tân Phú, Quận 7, TP.HCM

Điện thoại: (84.28) 54 16 17 18

Fax: (84.28) 54 17 18 19

11/08/2022

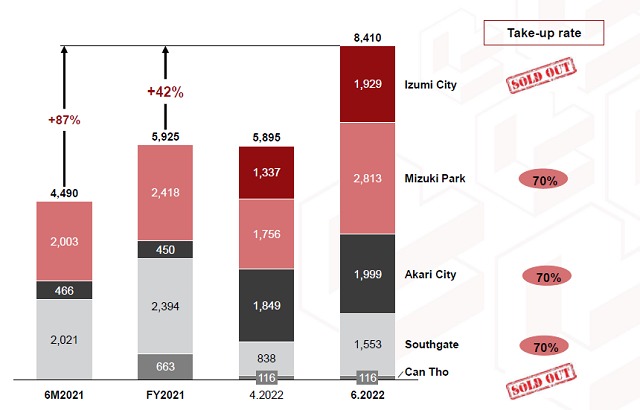

In 6 months, Nam Long revenue surpassed VND 8,400 billion, 87% higher compared to the same period last year.

The Group plans to sell 50% of its shares in Paragon Dai Phuoc for a profit of VND 350 billion, as well as shares in Izumi City and Waterpoint phase 2 over the next 2 years.

Nam Long uses its own fund and investment from partners in project development, without using loans with unusual interest rates.

Transfer 50% shares in Paragon Dai Phuoc for a profit of VND 350 billion

At the Nam Long Day event, Tran Xuan Ngoc, Nam Long’s General Director shared that 6-month revenue surpassed VND 8,410 billion, up 87% compared to the same period last year. This revenue mainly came from 5 projects, including Mizuki Park (HCMC), Izumi City (Dong Nai), Akari City (HCMC), Southgate (Long An) and Can Tho.

Nam Long’s sales revenue. Unit: billion VND. Source: Nam Long

This year, Nam Long projected a sales revenue of VND 23,000 billion, 4 times higher than previous year. So just within half a year, the company has accomplished 37% of the target.

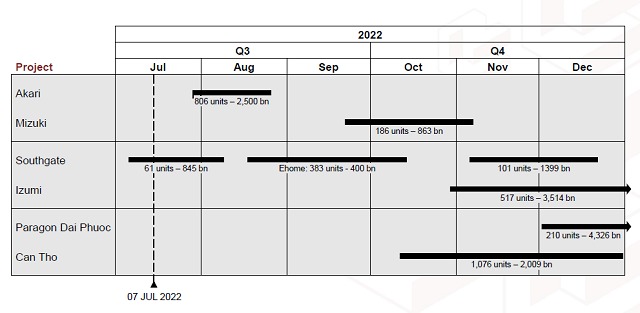

Nam Long expects to launch to market products from the above 5 projects in Q3 and Q4 this year. Besides that, in December, the first 210 properties in Paragon Dai Phuoc (Dong Nai) will also be rolled out, expecting to bring VND 4,326 in sales revenue.

Sales plan in the last 6 months of the year. Source: Nam Long

Talking about Paragon Dai Phuoc, Ngoc said the company plans to sell 50% of its share to Nishi Nippon Railroad, its Japanese long term partner. The deal is expected to bring back in revenue of VND 1,300 billion and profit after tax of VND 350 billion which will be recorded in the book this year.

According to Ngoc, in the period of 2023 - 2024, Nam Long might continue to sell its share in Izumi City (Dong Nai) or Waterpoint phase 2 (Long An). The transfer of these shares will ensure Nam Long’s cash flow and funding for project development without depending on bank loans. Recently, Nam Long has successfully raised VND 1,000 billion in bonds from IFC with interest rate of 9.35%/year for 7 years of which VND 500 billion was disbursed to Waterpoint Long An phase 2 development.

Determining appropriate capital structure following increases in interest rate

Nguyen Xuan Quang, Nam Long’s Chairman, said that tighter credit control policy may affect the entire market, but is indeed an opportunity for businesses that have been following the rules. All Nam Long’s businesses are happening as usual.

Quang expressed his biggest concern at the moment in the possibility that interest rates will increase in the near future and impact the real estate market, requiring developers to come up with solutions for example financial strategy, suitable products, etc. He recalled that in 2008 when the interest rate increased by 20% per annum, the Government stopped loans for real estate causing Nam Long to face challenges.

Having such experience, the Chairman shared that the Group capital is structured with its own money and investment from partners. Land acquisition will be funded by the Group’s capital or long-term loans. Investment from partners who have worked with Nam Long for a long time such as Nishi Nippon Railroad, Hankyu Hanshin (Japan) will be used for project development. The Company does not use loans with unusual interest rates.

Nam Long management and guests share information. Photo: Khong Chiem

Pham Dinh Huy, Investment Director added that in the future, with Nam Long's capital structure, the company will fund its M & A of land. The fund will be generated from sales, project fundraising, and help stabilize Nam Long’s cash flow. The company will also add to this fund VND 2,000 billion from private placement in 2021.

Mentioning the two Japanese partners and the partnership possibility, General Director Tran Xuan Ngoc said that their overseas businesses are very good, of which Vietnam is the best. So they wanted to invest in Nam Long and set ambitious objectives in the next 5 to 10 years. They see that in Vietnam, buying the first house is still hard, which was something that happened in Japan 40 to 50 years ago. This is an opportunity to develop affordable housing and the Japanese want to do it with Nam Long. Besides, two parties are also discussing development of commercial real estate.

Source: ndh.vn