CÔNG TY CỔ PHẦN ĐẦU TƯ NAM LONG (HOSE: NLG)

Số 6 Nguyễn Khắc Viện, P. Tân Phú, Quận 7, TP.HCM

Điện thoại: (84.28) 54 16 17 18

Fax: (84.28) 54 17 18 19

27/06/2022

The supply for housing is still limited. Especially in the affordable housing segment (under VND 30 million/m2), there is almost no stock in Q2/2021 while new products are launched in the second-home or high-end segments. This leads to the gap between the demand for residential projects and the supply from investors.

After the sharp increase, the investment market, in particular the stock market, is going through a significant correction. Many investors show concerns about the future of the real estate market, especially after the Tan Hoang Minh crisis. However, in the overall picture with high demand and attractive prices compared to the region, Vietnam's real estate market is still considered promising.

The latest report from Batdongsan.vn shows a stable economic growth this quarter with higher GDP growth than the same period in 2020 and 2021, reaching 5.03%. While FDI recorded across the industry decreased by 12% over the same period last year, FDI inflows into real estate increased by 213%. In particular, the number of newly established real estate businesses also increased by 47% compared to the same period in 2021. On the other hand, the Government is gradually making business activities transparent, allowing the real estate market to grow sustainably. This is the reason homebuyers are still positive about the market. The report also emphasised that real estate continues to be selected as the preferred investment compared to gold, securities, savings, etc.

From the business’s perspective, Nam Long’s representative recently shared: "The recent fluctuations in the market have caused the delay in approval of legal documents and funding in the market. This is followed by a slowdown in supply, along with rising interest rates and inflation, causing an impact on purchasing power.

The supply for housing is still limited. Especially in the affordable housing segment (under VND 30 million/m2), there is almost no stock in Q2/2021 while new products are launched in the second-home or high-end segments. This leads to the gap between the demand for residential projects and the supply from investors. This also creates an advantage for businesses that launch new products in the current period."

In 2022, NLG focuses on becoming an integrated township developer. According to the plan, the Company will simultaneously deploy large townships including Southgate (Waterpoint phase 1-165ha), Mizuki (26ha), Izumi City (170ha), Akari (8ha), Nam Long - Can Tho (43ha), Nam Long Dai Phuoc (45ha)… with the targeted sales revenue of USD 2 billion in the next 3 years. Of which, Nam Long Can Tho, Akari, Southgate and Nam Long Dai Phuoc contributed the majority of revenue and profit for this year.

Along the journey, NLG will continue to diversify the housing products in existing townships, launching new mid-end and high-end products, while maintaining the leading “affordable housing” products like EHome/Flora/Valora. At the same time, the Company is expanding its core business into commercial real estate, township management, and investing in ecosystems that serve the needs of living, working, entertaining, shopping and learning based on the integrated township model.

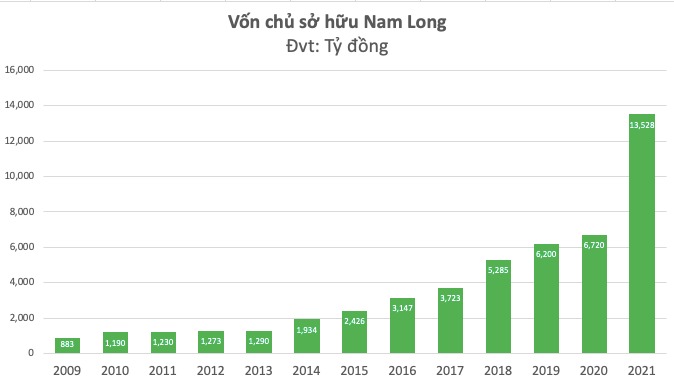

Established in 1992, with VND 700 million, Nam Long’s total capital has now increased to approximately VND 3,900 billion, while its portfolio includes major shareholders and investment partners such as IFC (Worldbank), Mekong Capital, ASPL, Nam Viet Ltd. (Goldman Sachs), etc.

"2023 marks 30 years of establishment and development of NLG. Preparing for this stepping stone, in 2022 the Company will take advantage of the existing legal land fund to continue developing and doing business (Akari project, Can Tho 43ha, Nam Long Southgate…). The current land fund (more than 650ha) can be sufficient for Nam Long to grow in the next 5-7 years", the representative emphasised.

Land acquisition is also prioritised, especially housing projects in HCMC and satellite cities such as Long An and Dong Nai. According to him, the Company's land acquisition policy is still flexible, including developing from raw land/non-resi land to the acquiring clean and ready-to-use land. NLG is leaning towards acquiring the land located near the company's existing projects.

To fund this plan, in 2021, NLG completed the private placement of 60 million shares, raising VND 2,100 billion and the Company's loans were also approved by banks. Fundraising and loan approval were successful ahead of 2022 when many changes in domestic policy as well as the world economy take place. Thanks to careful preparation, NLG has had sufficient financial and other resources including land, legal, human, and experience to follow through with the plan.

In addition, in April 2022, IFC registered to buy one trillion VND (about USD 44 million) in bonds issued by Nam Long. The company will use the proceeds from the bond issuance for Waterpoint phase 2- an integrated township project in Long An province, including green public space, sports facilities, schools, universities, healthcare facilities, as well as transportation, retail and office spaces.

The company revealed that it has researched a number of projects in Hanoi and Vung Tau, beside HCMC. However, the Company is still looking for more suitable projects.

Regarding fundraising, the representative also affirmed that the tightening of bond issuance policy is inevitably affecting NLG, but the Company has prepared in advance, by cooperating with international partners that have great financial potential.

Besides, the interest rate offered to Nam Long by local and foreignl banks is around 6.5%/year, so interest rate fluctuations are almost non-existent. As a reputable company on the stock exchange, all fundraising rounds have received support from partnered banks. Up to now, the Company is still working with credit rating companies to enhance its reputation in the market.

According to the plan, in 2022, Nam Long is expecting a revenue of VND 7,151 billion, up 37% and net profit of VND 1,206 billion, up 13% compared to 2021. With the foundation built over the past years, the Company also announced a projection for 2023 of VND 13,800 billion in net revenue and VND 1,996 billion in net profit, equivalent to an increase of times compared to the previous year.

By the end of the Q1/2022, NLG's revenue was recorded at VND 587 billion, 2.5 times higher than the same period last year. After cost deduction, gross profit was VND 250 billion, a sharp increase compared to VND 40 billion in Q1 last year. Due to the lack of revenue from other activities, NLG's NPAT reached nearly VND 33 billion, a sharp decrease of 91% compared to VND 365 billion in the Q1/2021. Profit mainly belongs to non-controlling shareholders, so the parent company's EAT is only VND 630 million, equivalent to EPS of only VND 2.

According to the Company’s explanation, the strong increase in revenue was mainly contributed by sales of houses and apartments. Net profit decreased because in the first quarter of last year, the profit of Waterfront Dong Nai City Co., Ltd was consolidated into the Group's financial statements.

"In Q1/2022, the Company sold shares of Paragon, but due to procedural problems, it could not recognize revenue. The deal value was about VND 350 billion, expected to be recorded in 2022", the management added.

Source: CafeF

16/01/2024

The lively look of Mizuki Park Township