CÔNG TY CỔ PHẦN ĐẦU TƯ NAM LONG (HOSE: NLG)

Số 6 Nguyễn Khắc Viện, P. Tân Phú, Quận 7, TP.HCM

Điện thoại: (84.28) 54 16 17 18

Fax: (84.28) 54 17 18 19

09/09/2020

With the total booking value soaked up to VND 7.5 trillion from Akari, Mizuki, Waterpoint projects in addition to other income from divestment, SSI Securities (SSI) expects a favorable result from Nam Long Investment Joint Stock Company (HOSE: NLG) in the period from 2021 to 2022. Along with over 681 hectares of clean land, NLG stock is also recommended by SSI, targeting VND 33,400 per share after 1 year.

Positivity from the balance sheet

In Q2, both Nam Long’s net revenue and net profit dropped down to VND 241 billion and VND 68 billion respectively, equal to a decline of 30% and 43% compared to same period last year. SSI pointed out that such low statistics mainly result from the timing of bookkeeping as profits are only recognized in the second half of this year after the first Waterpoint apartments are handed over and the selling of shares at Paragon and Waterfront projects are complete.

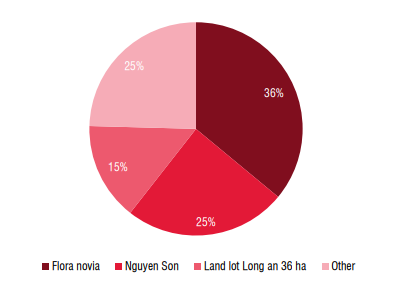

The total value of properties handed over in the first 6 months of 2020. Unit:%

Source: NLG, SSI Research

Although the results fell behind, NLG's balance sheet still shows some positivity. In particular, short-term prepayments reached more than VND 1.7 trillion, increased 30% from the end of 2019, due to the upfront payments of buyers for NLG’s apartments, villas and land plots. SSI estimates that prepayments will continue to go up in accordance with the payment schedule of the sales contract, often stretched over 12 to 16 months.

Besides, NLG also records a long-term unearned revenue of almost VND 670 billion from transferring a part of the Nguyen Son project to Mizuki, and a part of the Waterpoint project to Southgate. SSI predicts that this profit will be recognized after the paperwork related to the share transfer of these two projects is completed in 2020-2021. In Q2/2020, NLG also made the first payment of VND 906 billion to Keppel Land for the purchase of a 70% stake in the Waterfront project, recoded as a long-term investment on the balance sheet, equivalent to 11% of total investment cost. The Management Board has confirmed the selling of Waterfront in the last 6 months of 2021 as planned.

The sales is strongly recovered thanks to the Waterpoint project

In the first half of July, NLG sold nearly 300 low-rise apartments at Waterpoint. The total unearned revenue recorded is about VND 1.5 trillion. According to SSI, this is a favorable occupancy rate in the primary market for NLG products, as the total booking value increased 6 times compared to the previous quarter, bringing the total accumulated revenue from payments to VND 2.7 trillion, equivalent to 45% of the revenue plan in 2020.

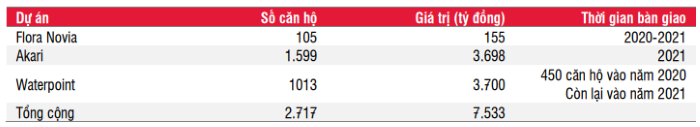

Total accumulated unearned revenue as of July 2020

Source: NLG, SSI Research

In the last 6 months of 2020, Nam Long will focus on the sales of 780 apartments at Mizuki, started in Q4, as well as of 200-300 apartments at Waterpoint to be able to reach the company's 2020 target.

SSI estimates that NLG's revenue will be approximately VND 1.5 trillion and net profit will be VND 830 billion by the end of 2020.

In 2021, SSI estimates that Nam Long's year-on-year net profit would increase 27% to VND 1.1 trillion, due to the handover of 35% of the apartments at Waterpoint from the beginning, and the handover of the Akari City’s phase 1 which is expected to complete by the end of this year.

NLG's current clean land fund is 681 hectares, giving NLG a competitive advantage compared to other investors from the South. With competitive pricing and proper development strategy for the middle segment, NLG is among the few qualified developers who can develop the sought-after township project models (over 100 ha per project) in the outskirt of HCMC.

Following the listed advantages along with the low-interest rate condition and increasing demand for properties that are safe to invest, SSI believes that NLG can achieve the occupancy rate and sales targets while other developers struggle with the legal procedures of on-going projects. Therefore, SSI continues with buying recommendations for NLG stock, with a target price of 33,400 VND per share, and based on the RNAV method, the expected increase is 26% (compared to 11/08/2020).

On August 6, 2020, Nam Long, Hankyu Hanshin, Nishi Nippon Railroad (Japan) joined the roof topping ceremony for phase 1 of the 8.5ha Akari City project in Vo Van Kiet, Binh Tan district.

Akari City consists of 6 blocks, each of them has 1 basement, 21 floors, and an approximate of 1800 apartments. The investor made a commitment to handover this project to the customer in Q3/2021.

Nam Long previously announced the 3rd housing savings program in cooperation with Vietcombank (VCB). This program is applicable for 650 Flora apartments in the 3 blocks MP6, MP7, and MP8 at the 26-hectare Mizuki Park township.

Source: Vietstock.vn

16/01/2024

The lively look of Mizuki Park Township